The Most Important Economic Statistic That People Rarely Talk About

This post was originally published on this site

People are rightly focused on government spending, GDP growth, increases in the deficit and debt, and obviously inflation.

Each of those matters quite a bit, obviously, but the most important measure of the health of the economy is usually left out of economic discussions: productivity growth.

Advertisement

The United States doesn’t have its fiscal house in order, and it is true that runaway government spending and rapidly increasing debt threaten our prosperity. Government spending has been driving a large chunk of the inflation we have seen, and that leads directly to the pain we are feeling.

But the single-biggest reason that the United States still can have a bright future is that Americans themselves are extremely productive–we are by far the most productive economy in the world, save a few tiny countries. Compared to our peers the United States is a standout because US workers are just that much more productive than everybody else.

Why has productivity (GDP per hour worked) grown faster in the US than in Europe over the last 15 years.

[note: if you think this is because Americans work more than Europeans, you are wrong. Productivity measures output *per hour worked*] https://t.co/p80CKhTNFP

— Yann LeCun (@ylecun) June 18, 2024

Most people don’t understand how much the EU economy has stagnated while, for all its flaws, the US economy keeps growing. Americans in the poorest states are as wealthy or wealthier than Europeans. People may think that our poorest states are backwaters, but compared to Europe, they are doing extremely well.

Part of the reason why we think of Europe as wealthier than it is is simple: Americans know how the American middle-class lives, and we compare ourselves to how European elites live. When we think of France, we think in tourist terms and envision living in central Paris, eating baguettes and brie, and think that the worst part of the experience is considering buying a Peugeot.

Advertisement

Uh, no. For all the talk about Europeans being poorer than Americans because they choose a more relaxed lifestyle, the truth is that the economic rot in Europe runs deep. Even former powerhouse Germany is deindustrializing due to the sclerotic economy, Net-Zero policies, and a technocracy that runs the country for itself.

Recent gap in performance has been staggering…

2010-2023:

🇪🇺 EU productivity: +5%

🇺🇸 US productivity: +22%GDP Share (1960 vs 2024):

🇪🇺 EU: 34% → 15%

🇺🇸 US: 28% → 25% pic.twitter.com/A47cY0zUsr— Alessandro Palombo (@0x_ale) December 5, 2024

Of course, being the best of a bad lot is still being in a bad lot, but America’s main problem isn’t our private sector, which is not, on the whole, declining. Rather it is the dysfunction in government that is the greatest threat to our future.

This chart puts into perspective that even without factoring in the cost of servicing the debt, fiscal spending alone represents over 25% of GDP in the US.

Today’s government expenditure has already surpassed the levels seen after the Global Financial Crisis.

The notable… pic.twitter.com/VLPJl1Jf4l

— Otavio (Tavi) Costa (@TaviCosta) September 7, 2023

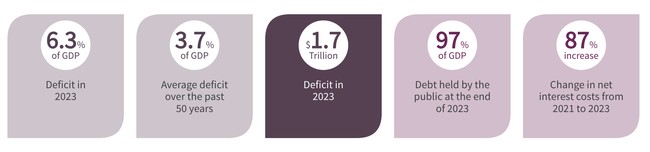

Interest on the federal debt and the size of the deficit are, by far, the biggest threat to our economic future, and the problem has ballooned in scope over the past few years.

As you can see, according to the Congressional Budget Office the size of the deficit is about 80% higher in terms of GDP and the interest on the debt is almost 90% higher than three years ago. That is a total disaster.

As you can see, according to the Congressional Budget Office the size of the deficit is about 80% higher in terms of GDP and the interest on the debt is almost 90% higher than three years ago. That is a total disaster.

Advertisement

But for those of you who behold and despair, there is hope–and the hope is that with a dramatic drop in deficit spending or, God willing, elimination of the deficit entirely (good luck with that!), we don’t have to inflate away the debt and destroy our economy by destroying the dollar.

Output per hours worked (“labor productivity”) has increased *much* more in the US than in other advanced economies since the pandemic.

Maybe using an economic policy strategy aimed at running the economy hot was not a bad idea after all?

chart via @JosephPolitano pic.twitter.com/dA1LF7fs0A

— Philipp Heimberger (@heimbergecon) November 5, 2024

Productivity growth, and especially continued innovation, will allow us to scale the Mount Everest of economic problems.

The rest of the world still invests in the United States and our national debt because all things being equal, we are still the best place to invest. Our private sector is dynamic (less so the big corporations, but the big corporations are not where the action is), and change happens here, not in sclerotic Europe or worker bee China. We invent things, and others copy them.

“US labour productivity has grown by 30 per cent since the 2008-09 financial crisis, more than three times the pace in the Eurozone and the UK. That productivity gap, visible for a decade, is reshaping the hierarchy of the global economy.”

This quote and the charts below are from… pic.twitter.com/fPGoki3mqQ— Mohamed A. El-Erian (@elerianm) December 3, 2024

Advertisement

Slashing government regulations and getting the deficit under control would be enough to right the ship. Sure, the debt would remain a drag on the economy, and we need to reverse the trend and shrink it, but you really can grow your way out of the debt if you don’t keep adding to it. We don’t need it to be zero, just manageable.

Almost all the worst economic problems we face are caused by the government. That’s why CEOs from the innovative side of the economy–those who don’t lobby the government to give them an unfair advantage in order to grow profits–backed Trump this time.

We need DOGE to succeed. It is the key to America’s success.